Fed Drains $351 Billion in Liquidity from Market via Reverse Repos, as Banking System Creaks under Mountain of Reserves | Wolf Street

Fed Drains $351 Billion in Liquidity from Market via Reverse Repos, as Banking System Creaks under Mountain of Reserves | Wolf Street

Re‐Use of Collateral in the Repo Market - FUHRER - 2016 - Journal of Money, Credit and Banking - Wiley Online Library

The Basel III liquidity standards and their implementation into EU legislation Seminar on Basel II Enhancements Basel, Switzerland, 27–29 April 2010 Stefan. - ppt download

A pragmatic solution for the liquidity in resolution problem, SUERF Policy Notes .:. SUERF - The European Money and Finance Forum

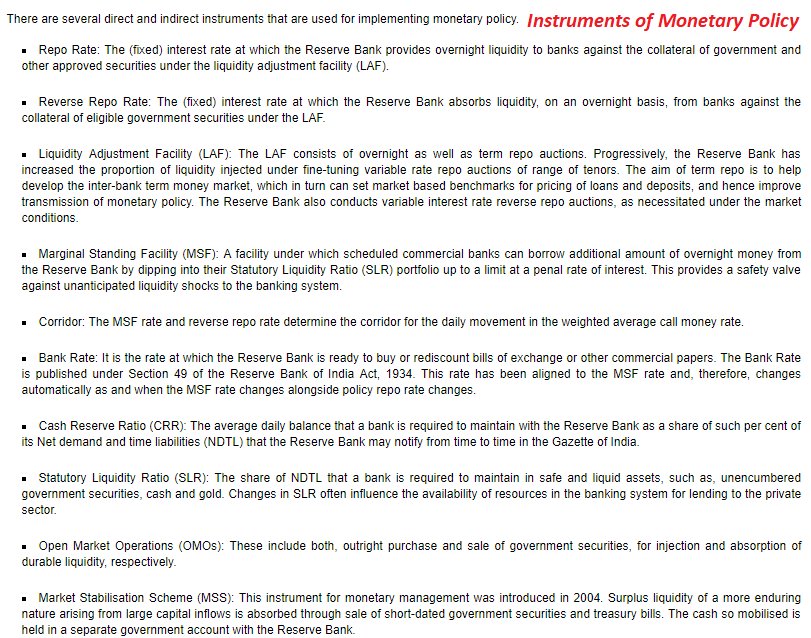

RamaKrishna Vadlamudi, CFA on Twitter: "@RBI Monetary Policy Tools used by RBI: Repo rate Reverse repo rate LAF MSF - marginal standing facility Corridor of WACM rate b/w MSF rate and reverse

Sree Marketing Services - https://scrlibrary.blogspot.com/2020/03/monetary-policy-rates.html | Facebook